Duty?

-

Forum Statistics

352.3k

Total Topics4.6m

Total Posts -

Member Statistics

125,505

Total Members2,359

Most OnlineNewest Member

tpearhart

Joined -

Images

-

Albums

-

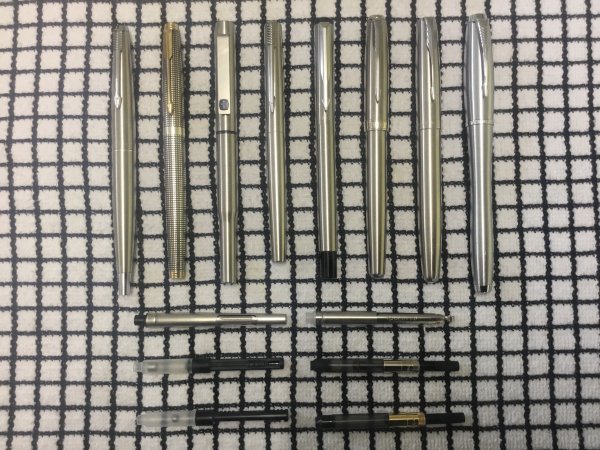

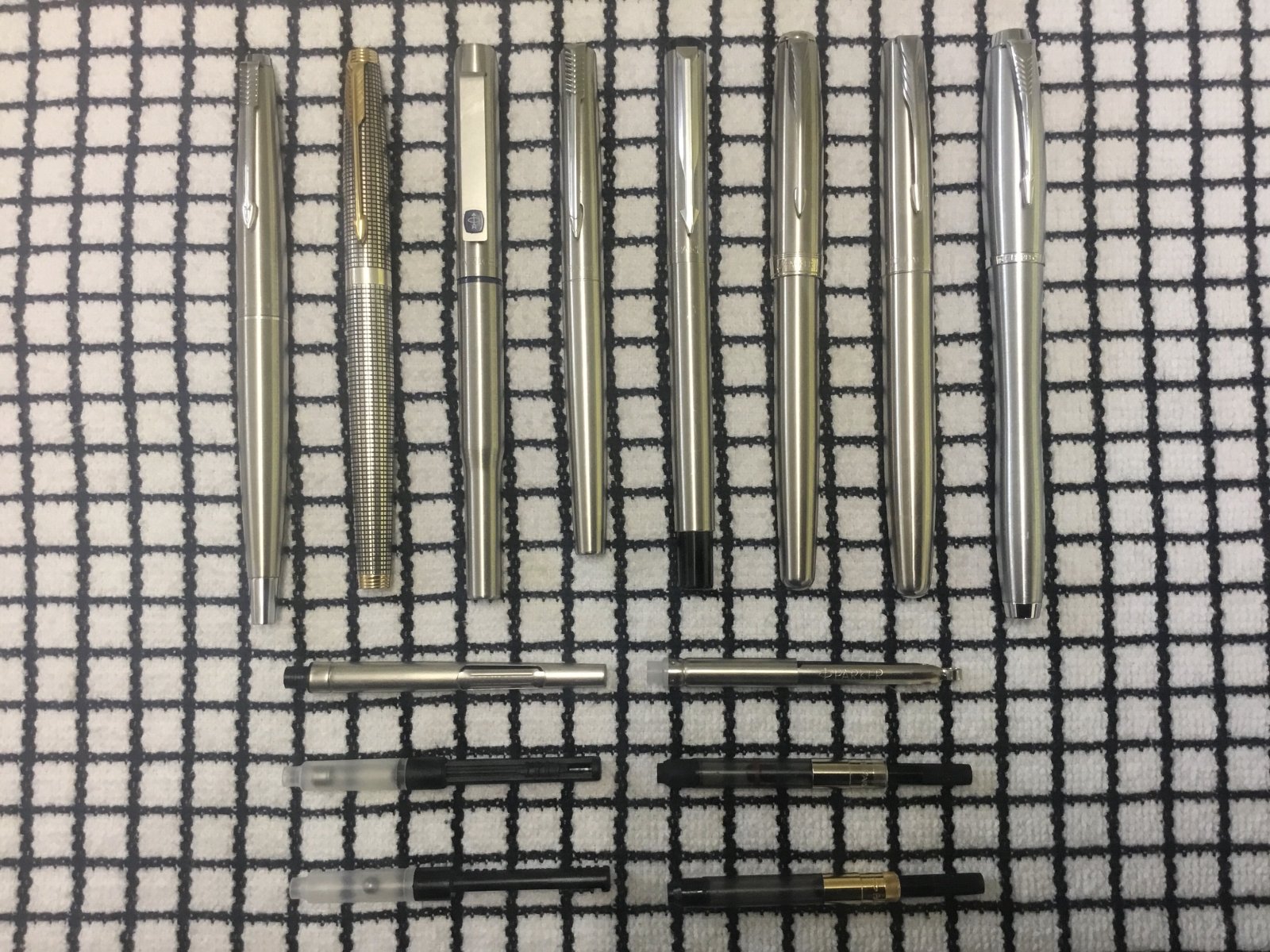

Mercian’s pens

- By Mercian,

- 0

- 21

- 57

-

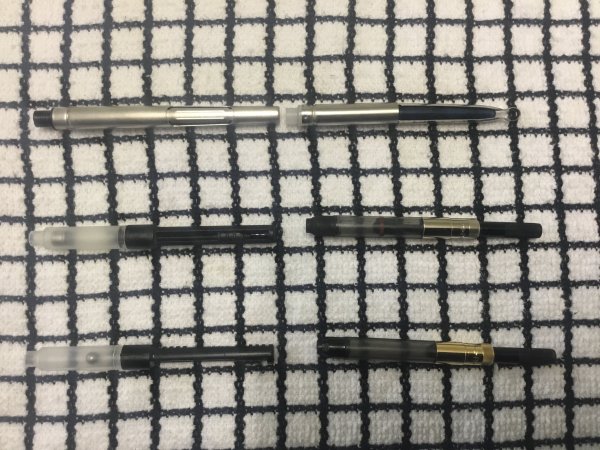

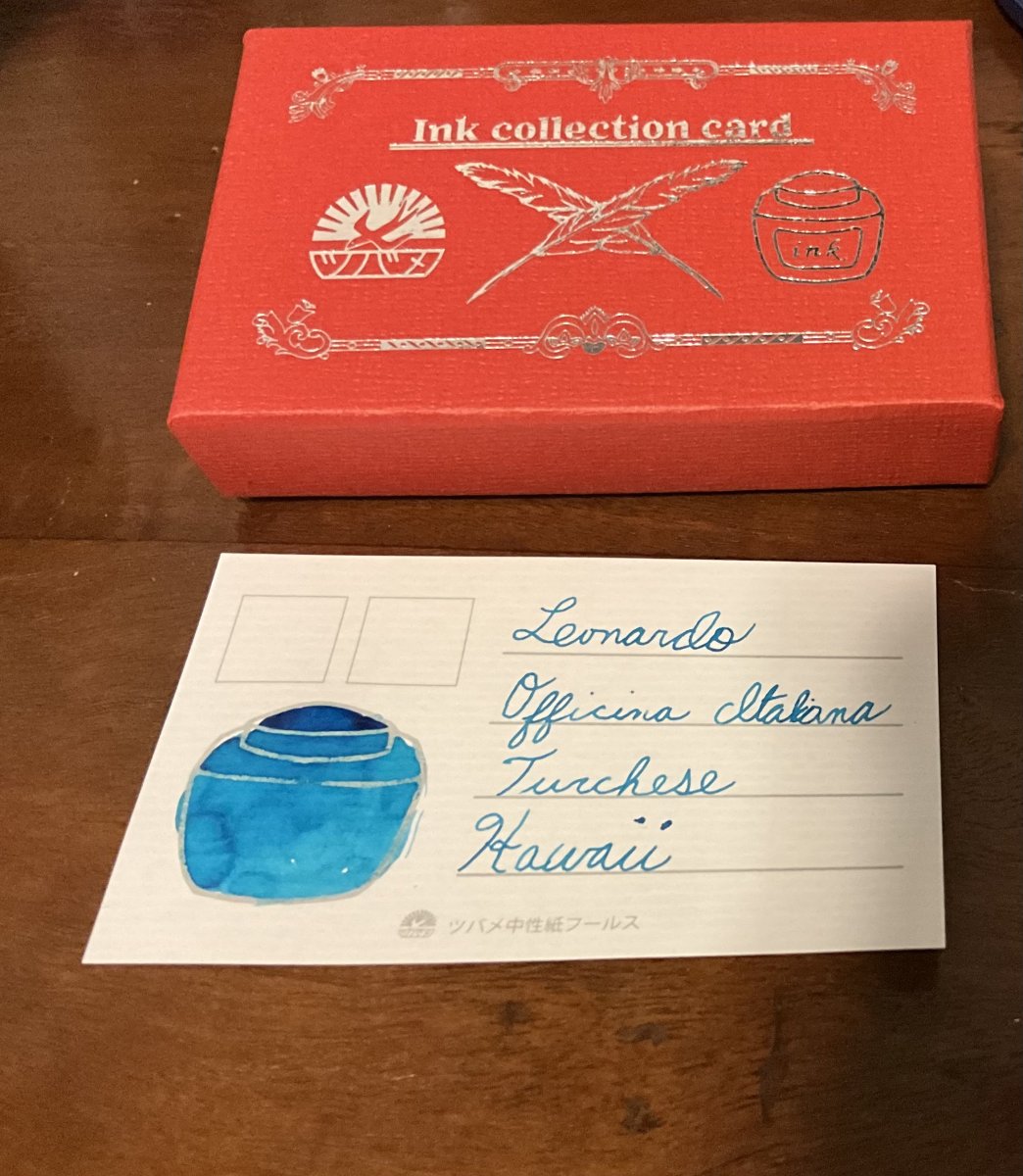

Ink

- By Penguincollector,

- 0

- 2

- 13

-

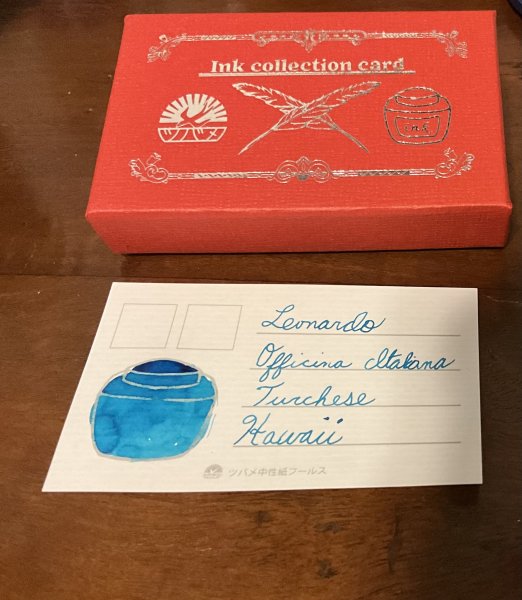

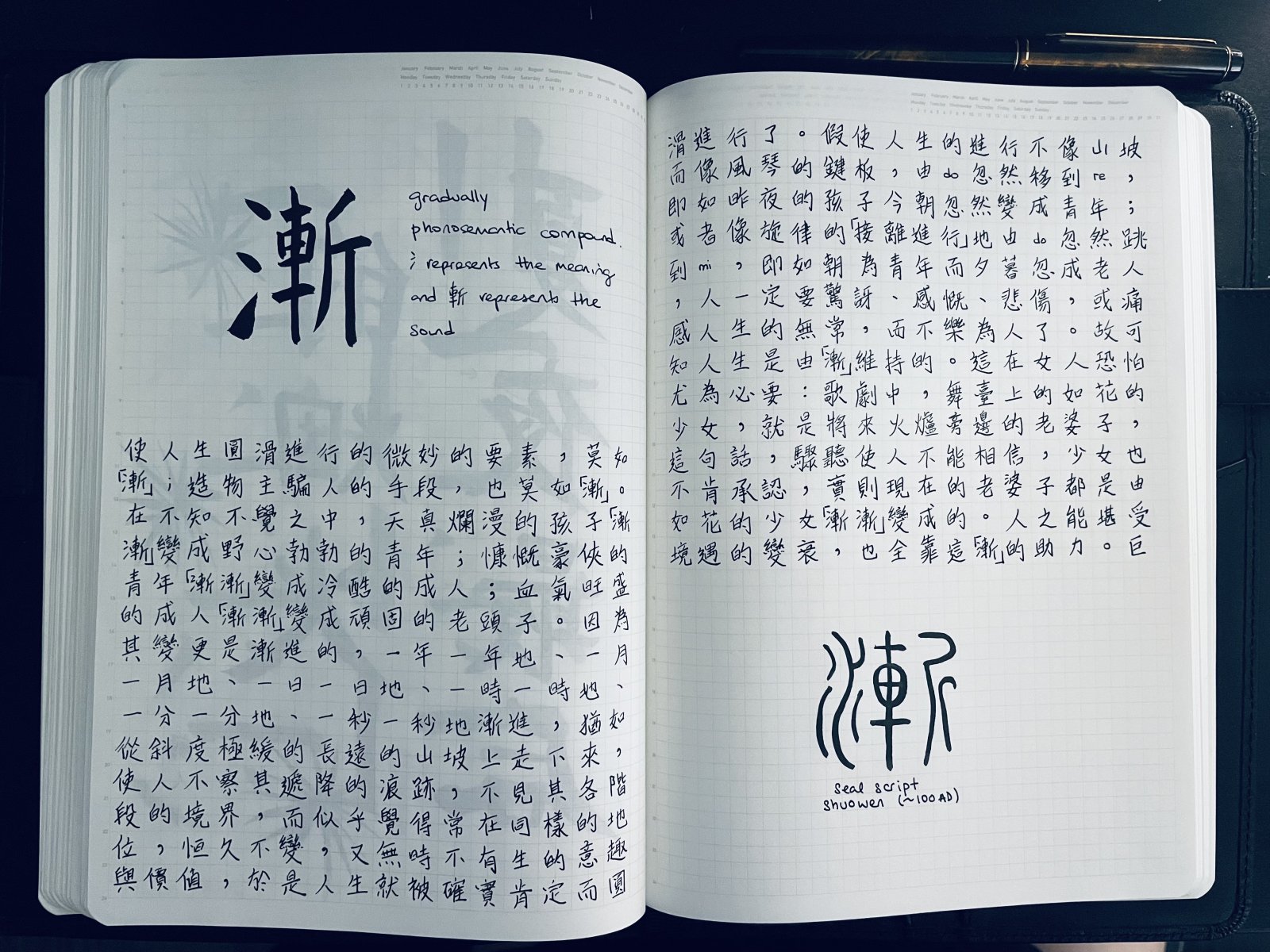

j1tters

- By 2ouvenir,

- 0

- 1

- 23

-

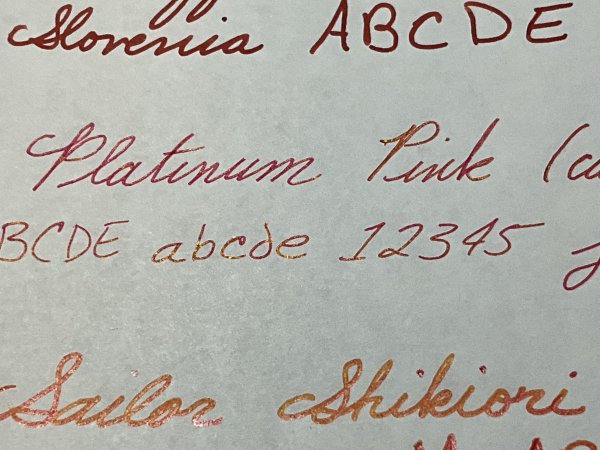

namrehsnoom-14

- By namrehsnoom,

- 0

- 0

- 85

-

other

- By shalitha33,

- 0

- 0

- 31

-

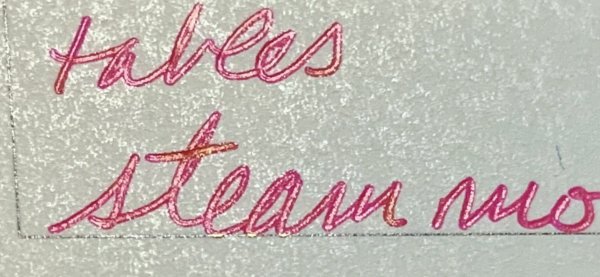

.thumb.jpg.f07fa8de82f3c2bce9737ae64fbca314.jpg)

desaturated.thumb.gif.5cb70ef1e977aa313d11eea3616aba7d.gif)

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now