Fountainfeder For Diamine German Exclusives

-

Forum Statistics

352.3k

Total Topics4.6m

Total Posts -

Member Statistics

125,516

Total Members2,359

Most OnlineNewest Member

ukiha

Joined -

Images

-

Albums

-

Misfit’s 4th album of Pens etc

- By Misfit,

- 99

-

Mercian’s Miscellany

- By Mercian,

- 0

- 14

- 22

-

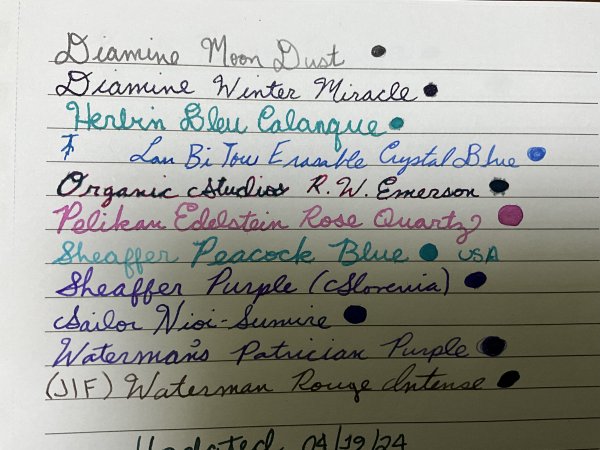

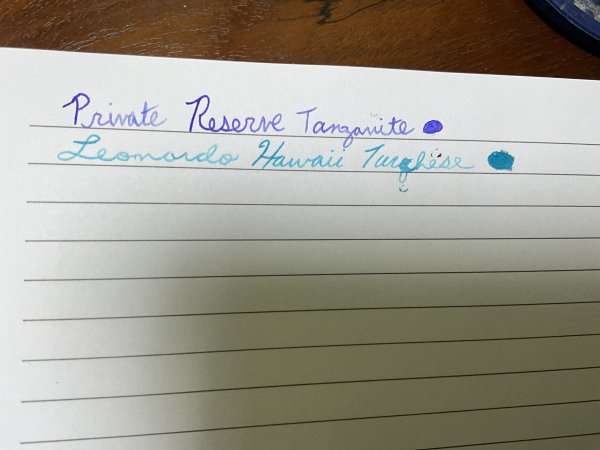

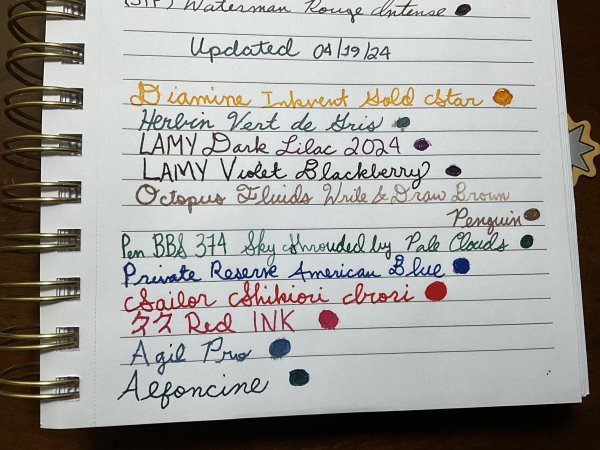

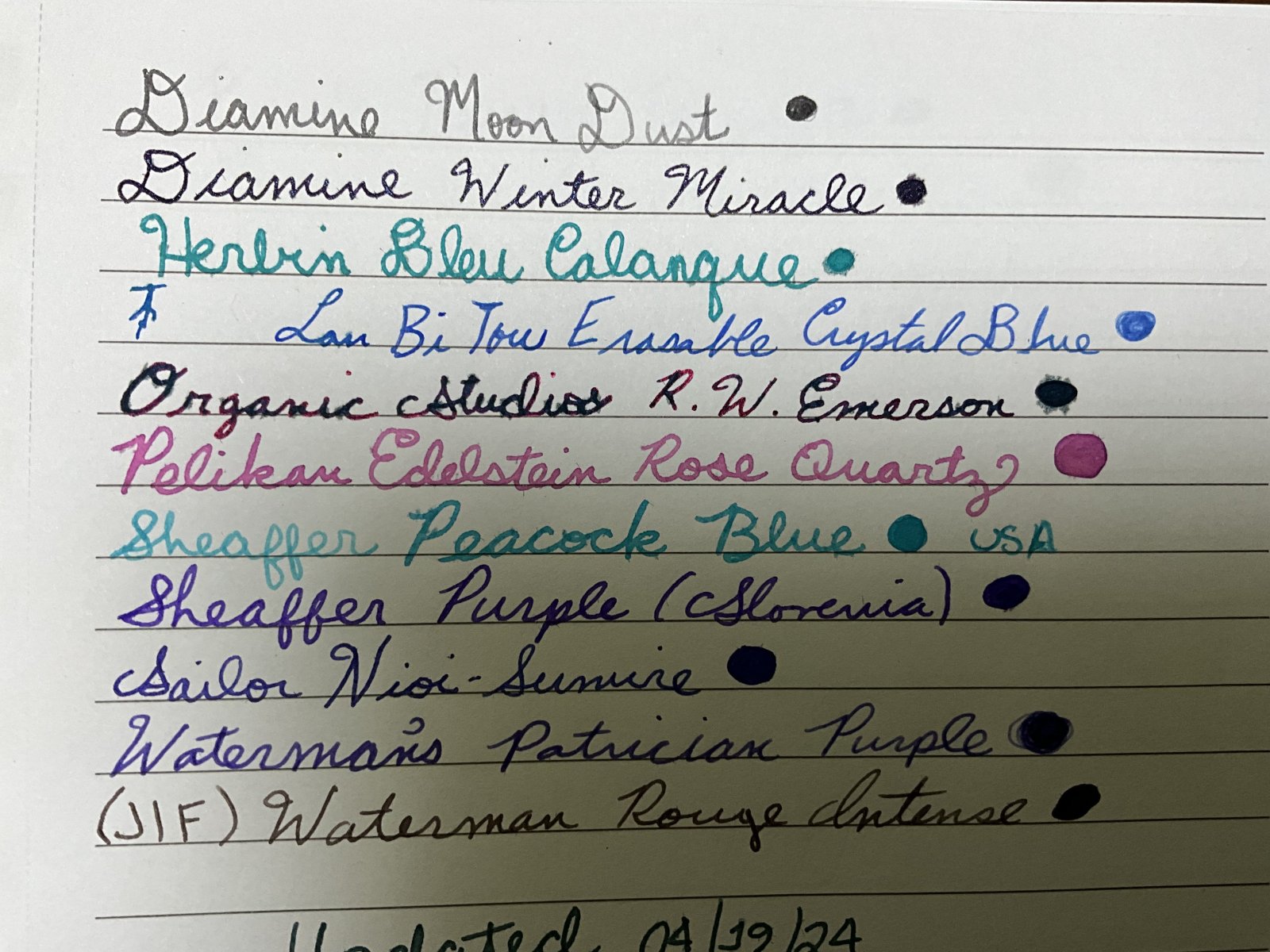

Sample Inkventory

- By Penguincollector,

- 0

- 0

- 10

-

gweimer1 gallery

- By gweimer1,

- 0

- 0

- 2

-

karmachanic 1

- By Karmachanic,

- 0

- 0

- 29

-

.thumb.jpg.f07fa8de82f3c2bce9737ae64fbca314.jpg)

desaturated.thumb.gif.5cb70ef1e977aa313d11eea3616aba7d.gif)

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now