I can understand some eBayers not selling overseas

-

Forum Statistics

352.2k

Total Topics4.6m

Total Posts -

Member Statistics

125,472

Total Members2,078

Most OnlineNewest Member

Ron The gold guy

Joined -

Images

-

Albums

-

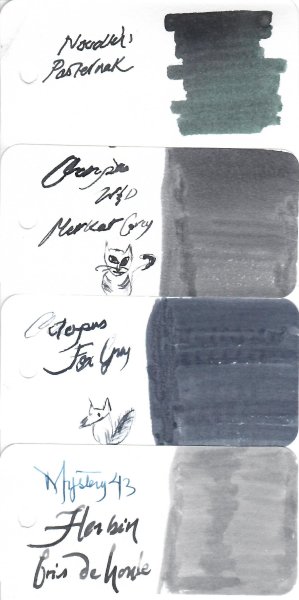

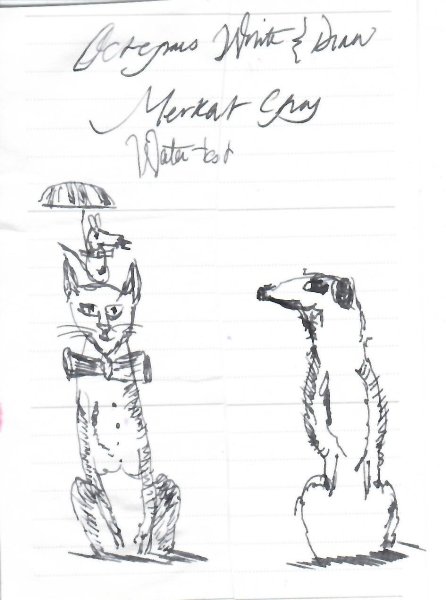

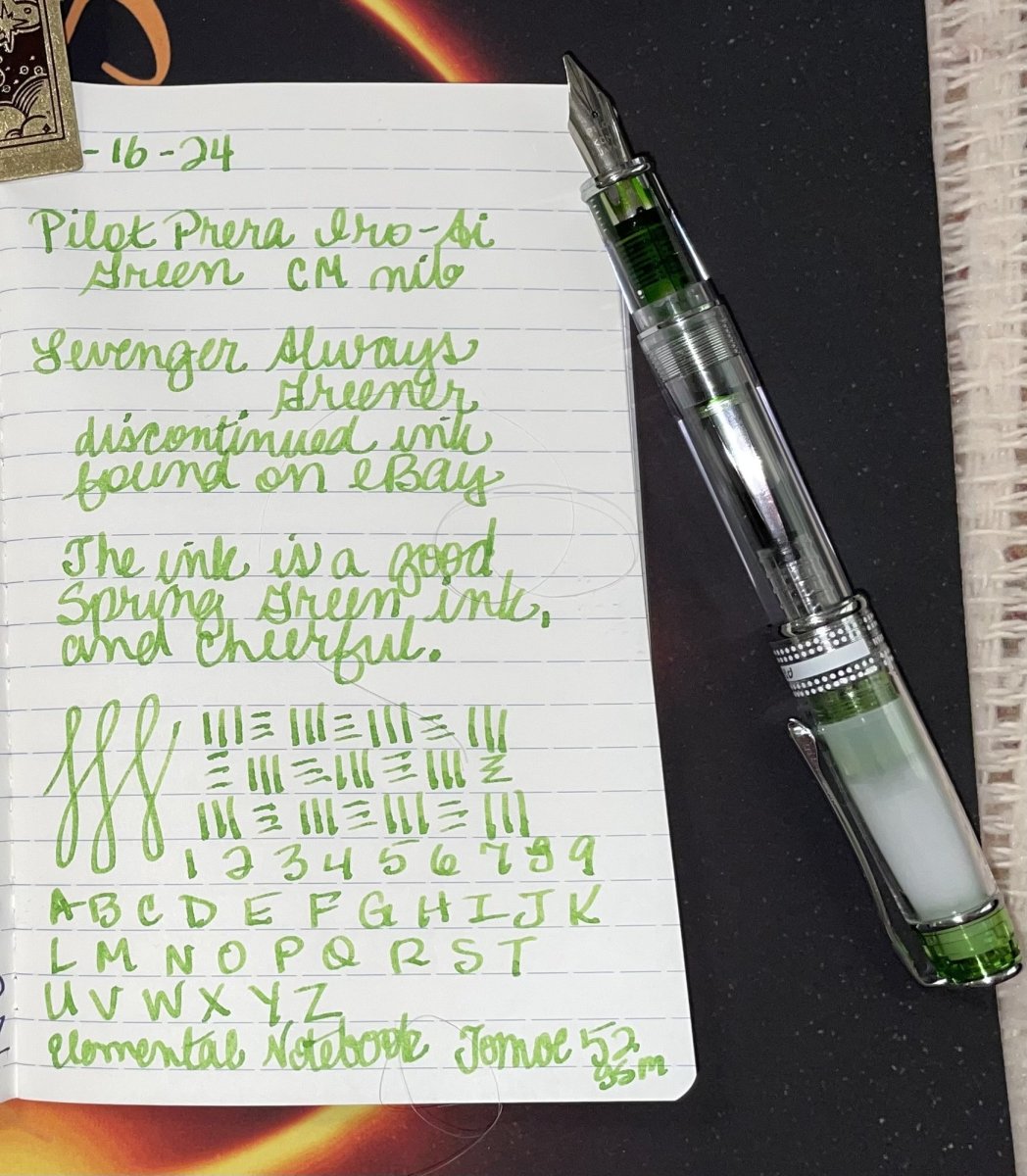

Ink

- By Penguincollector,

- 0

- 0

- 5

-

Nethermark Osmia

- By Nethermark,

- 0

- 0

- 26

-

March- April -2024

- By yazeh,

- 0

- 0

- 43

-

For The Posts

- By ZeroDukE,

- 96

-

Misfit’s 4th album of Pens etc

- By Misfit,

- 98

-

.thumb.jpg.f07fa8de82f3c2bce9737ae64fbca314.jpg)

desaturated.thumb.gif.5cb70ef1e977aa313d11eea3616aba7d.gif)

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now